How to Measure Marketing ROI for Real Business Growth

Measuring marketing ROI is all about one thing: calculating the profit your campaigns generate compared to what they cost you. It’s not about revenue; it’s about what’s left in the bank.

The formula itself is brutally simple: (Incremental Profit – Marketing Cost) / Marketing Cost. Getting this right, however, is where most marketing teams stumble, leading to some seriously flawed decisions.

Establishing Your ROI Measurement Framework

Before you even think about attribution models or fancy dashboards, you need a solid framework. This is the first, and most critical, step. Too many businesses fall into the trap of just using the default metrics from platforms like Meta or Google.

They proudly point to a high “Return on Ad Spend” (ROAS), but that metric is a wolf in sheep’s clothing. It’s based entirely on revenue, not profit, and that distinction can make or break your business. For a deeper dive, plenty of great guides cover the essentials of how to calculate marketing ROI.

A killer ROAS can give you a false sense of security. I’ve seen campaigns that look wildly successful on paper, pulling in big revenue numbers, but they’re actually losing money on every single sale because the product margins are razor-thin. This is why you need one, unified, profit-centric formula across every channel you use. It’s the only way to get insights you can actually trust.

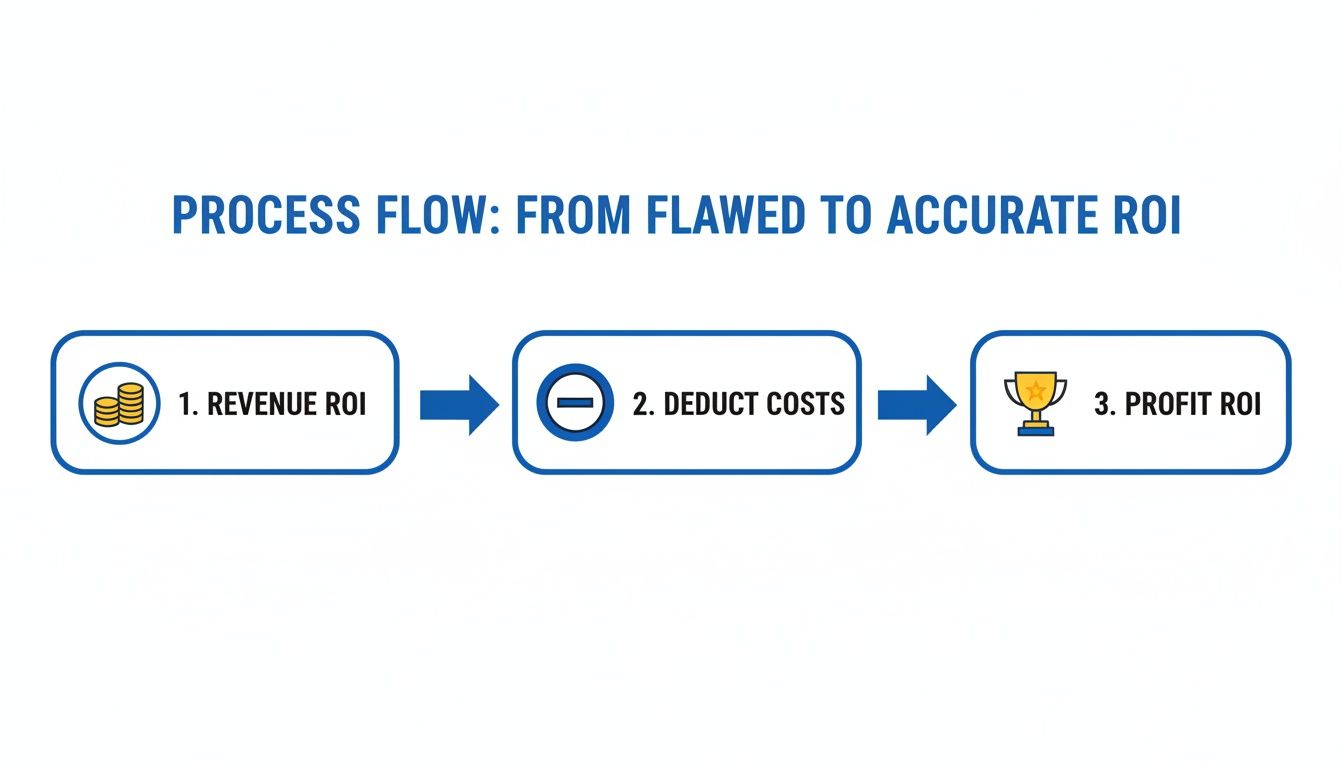

Differentiating Revenue ROI from Profit ROI

The most important shift you can make is moving from a revenue-first mindset to a profit-first one. Revenue ROI (what platforms call ROAS) just looks at the total sales value generated for every pound spent. It’s a decent top-level signal, but it tells a dangerously incomplete story.

Profit ROI, on the other hand, forces you to look at the actual cash a campaign adds to your bottom line after all the associated costs are stripped out.

To get to that real profit number, you have to factor in everything:

- Cost of Goods Sold (COGS): What it actually costs you to make or acquire the products you sold.

- Fulfilment and Shipping Costs: All the expenses for picking, packing, and posting the orders.

- Transaction Fees: The cut that payment processors like Stripe or PayPal take.

- Returns and Refunds: The cost of handling items that customers send back.

This is the only way to move from a vanity metric to a sanity metric.

As the diagram shows, the real picture of profitability only emerges after you subtract all those business costs from the top-line revenue.

Here’s a table that breaks down just how different the story can be when you compare these two metrics side-by-side.

Revenue ROI vs Profit ROI: A Comparison

| Metric | Revenue ROI (ROAS) | Profit ROI |

|---|---|---|

| Calculation | (Revenue / Marketing Spend) | ((Revenue - COGS - Other Costs) - Marketing Spend) / Marketing Spend |

| Focus | Top-line sales efficiency | Bottom-line profitability |

| Example Ad Spend | £1,000 | £1,000 |

| Example Revenue | £4,000 | £4,000 |

| Example Total Costs | N/A | £2,400 |

| Calculated ROI | 400% (or 4x) | 60% (or 0.6x) |

Notice the massive difference? One metric tells you the campaign is a huge success, while the other gives you a much more sober, realistic view of its actual financial contribution.

A Real-World Ecommerce Example

Let’s make this tangible. Imagine a UK-based ecommerce store selling artisan coffee. They run a Meta Ads campaign, spending £1,000 to generate £4,000 in sales. The Meta Ads Manager is glowing, reporting a fantastic 4x ROAS. Looks like a win, right?

Not so fast. Let’s dig into the real numbers:

- Revenue: £4,000

- Marketing Spend: £1,000

- Product Margin: Their product margin is 55%, which means their Cost of Goods Sold (COGS) is £1,800.

- Other Costs: Fulfilment, shipping, and transaction fees chew up another 15% of the sale price, which comes to £600.

Now, let’s calculate the real profit from this campaign: £4,000 (Revenue) - £1,800 (COGS) - £600 (Other Costs) = £1,600 (Incremental Profit).

Plugging that into our Profit ROI formula: (£1,600 - £1,000) / £1,000 = 0.60 or 60%.

A campaign that looked like a 400% winner based on revenue was actually only a 60% winner when we looked at profit. This is the kind of insight that stops you from pouring money into campaigns that are slowly bleeding you dry.

This isn’t just a one-off scenario. It’s a common trap. While ROAS can be a useful directional metric, it’s never the full story. If you want to learn more about its specific uses and limitations, check out our complete guide on https://menza.ai/blog/how-to-calculate-roas/.

This profit-first approach isn’t just theory; it’s a non-negotiable for anyone serious about building a sustainable business on the back of paid marketing.

Connecting Your Data for Accurate Calculations

If you’re only looking at the ROAS inside your ad platforms, you’re flying blind. Truly accurate ROI isn’t magic; it’s data. To get beyond those often misleading numbers, you have to build a single, unified view of the entire customer journey and every cost associated with it.

This means connecting your whole marketing and sales stack to see what’s happening between the platforms.

It all starts by mapping out the essential data sources that hold a piece of the profitability puzzle. Your goal is to pull the right information from each system to build a complete financial picture for every single transaction. It’s the only reliable way to measure marketing ROI.

Identifying Essential Data Sources

For most e-commerce businesses, the core data is spread across a few key platforms. Each one provides a different, but critical, layer of information you’ll need for your profit calculations.

You’ll need to pull data from:

- Ad Platforms: This is your starting point for Marketing Cost. Think Google Ads, Meta Ads, and TikTok Ads. This is where you’ll find your spend, clicks, and impressions.

- E-commerce Store: Your storefront, likely Shopify or WooCommerce, is the source of truth for Revenue. It also holds crucial cost info like product-level COGS and customer order history.

- Email & SMS Platforms: Systems like Klaviyo hold the data on revenue generated from specific campaigns and flows, which is vital for attributing sales back to your owned channels.

- Finance Systems: Don’t forget your accounting software (e.g., Xero, QuickBooks). This is where you’ll find the final numbers on overheads, operational costs, and true profit margins that need to be factored in.

Connecting these is foundational. For many brands, figuring out how to properly sync Shopify and Klaviyo data is one of the first big steps toward getting a clearer picture of their email marketing performance.

The Power of Consistent UTM Tagging

Once you know where your data lives, you need a way to trace every visitor and every pound spent back to its source. This is where Urchin Tracking Module (UTM) parameters become your best friend. They’re simple tags you add to the end of your URLs that tell your analytics tools exactly where a user came from.

Consistent UTM usage is completely non-negotiable for accurate ROI measurement. It lets you answer questions like, “Which specific Facebook ad creative drove the most profitable customers?” without any guesswork.

A robust UTM strategy is the bedrock of reliable attribution. It turns a chaotic mess of traffic sources into an organised, analysable dataset, allowing you to connect ad spend directly to profit.

By enforcing a standardised naming convention for your campaigns (utm_campaign), sources (utm_source), and mediums (utm_medium), you create clean data that makes ROI analysis by channel not just possible, but straightforward.

Unifying Your Data for a Single View

Manually exporting CSVs from each platform every week is a recipe for errors and wasted time. The modern approach is to automate this data integration, creating a single source of truth for all your performance metrics. This is usually done with data pipeline tools or specialised analytics platforms.

This unified view is especially critical in the UK, where marketers are under constant pressure to justify their budgets. The UK digital ad market generated USD 40.24 billion in 2024, a figure expected to rocket to USD 95.73 billion by 2030. With smartphones accounting for over 58% of this spend, our data is more fragmented than ever, making it essential to connect these touchpoints to actual sales. You can explore more about the UK’s digital advertising market trends on Grand View Research.

By connecting these disparate systems, you ensure your ROI calculations are always based on comprehensive, up-to-date data. This automated approach means you spend less time wrestling with spreadsheets and more time making the strategic decisions that actually drive profitable growth.

Choosing an Attribution Model That Fits Your Business

How do you give credit where it’s due? In a world of complex customer journeys, this is the core challenge of marketing attribution. Getting it wrong can completely derail your ROI measurements.

Most platforms default to a last-click attribution model, which hands 100% of the credit to whatever a customer touched right before buying. It’s simple, sure. But it’s also dangerously misleading. This model systematically ignores all the early and mid-funnel marketing that introduced a customer to your brand and nurtured their interest in the first place. To accurately measure your marketing ROI, you have to look beyond the default and pick a model that actually reflects how your customers find you.

Think about a typical customer journey. A potential buyer first sees your product in a Meta ad but scrolls past. A week later, they search for a solution on Google, click your ad, and browse your site. The next day, they get an abandoned cart email and finally make a £100 purchase.

How should that £100 in revenue be attributed? The answer changes completely depending on the model you use.

Comparing Common Attribution Models

Different models will tell you a completely different story about which channels are driving results. Let’s break down how each one would assign credit in our £100 sale scenario.

- Last-Click Attribution: This is the common default. It gives 100% of the credit (£100) to the final email click. The Meta and Google ads get zero recognition, making them look like failures.

- First-Click Attribution: The mirror opposite. This model assigns 100% of the credit (£100) to the very first touchpoint—the Meta ad view. In this world, the Google ad and email are seen as worthless.

- Linear Attribution: This multi-touch model spreads the credit equally across all touchpoints. In our example, the Meta ad, Google ad, and email would each receive £33.33 in credit.

- Time-Decay Attribution: This model gives more credit to touchpoints closer to the conversion. The email click might get £50, the Google ad £30, and the initial Meta ad view just £20.

- Position-Based (U-Shaped) Attribution: This model credits the first and last touches the most, splitting what’s left among the middle interactions. For instance, the Meta ad and the email might each get £40, while the Google ad in the middle receives £20.

Choosing the right attribution model is less about finding a perfect answer and more about finding the model that best aligns with your business goals. A model that works for a high-growth startup focused on awareness will be different from one used by an established brand optimising for conversion efficiency.

Selecting the Right Model for Your Business

So, which model should you actually use? While there’s no single correct answer, there are clear guidelines to help you decide.

For businesses with short sales cycles where the main goal is closing deals, last-click or time-decay models can be useful. They shine a light on the channels that are most effective at pushing customers over the finish line. The risk, of course, is that they undervalue brand-building activities that don’t lead directly to a sale.

If your primary goal is customer acquisition and understanding how people first discover you, a first-click model offers incredible insight. It helps you identify which top-of-funnel channels are best at filling your pipeline.

But for most businesses with a multi-step customer journey, a multi-touch model like linear or position-based provides a more balanced and realistic view. These models acknowledge that every interaction has value, preventing you from mistakenly cutting budgets for channels that play a crucial supporting role.

Ultimately, the most sophisticated approach involves a data-driven attribution model. These models use machine learning to analyse all converting and non-converting paths, assigning credit based on the actual impact of each touchpoint. When you’re ready to get more advanced, consider exploring guides on developing data-driven attribution models for more precise, automated insights.

The key is to move beyond the default setting and intentionally select a model that reflects your strategic priorities. This choice is fundamental to generating ROI figures you can genuinely trust to guide your budget.

Look Beyond the First Sale With LTV

A single purchase rarely tells you the whole story. If your entire view of profitability is based on a customer’s first transaction, you’re making short-sighted decisions that will absolutely stunt your long-term growth. This is where focusing on Customer Lifetime Value (LTV) completely changes the game.

When you only care about immediate returns, you naturally undervalue the channels that bring in high-value, loyal customers who buy again and again. It’s a classic trap: you pour your budget into a channel that delivers a quick, cheap win but attracts one-off buyers, while starving the channel that brings in customers who stick around for years.

You’re winning the battle but losing the war.

By bringing LTV into the equation, you shift from thinking about transactional gains to building sustainable, long-term profitability. It lets you see the full financial impact of your marketing over the entire customer relationship.

Your North Star Metric: The LTV to CAC Ratio

The most powerful way to use LTV is to stack it up against your Customer Acquisition Cost (CAC). The LTV to CAC ratio is a simple but profound metric. It tells you exactly how much value you’re generating for every pound you spend to get a new customer.

A healthy ratio is typically seen as 3:1 or higher, signalling a sustainable business model. It means for every £1 you spend to acquire a customer, you can expect to get £3 back over their lifetime. A ratio below 1:1 is a massive red flag—you’re literally paying more for customers than they’re worth.

This ratio becomes your guide for strategic budget allocation. It gives you the confidence to invest in channels that might have a higher upfront CAC but deliver exceptional long-term value, ensuring your growth is both scalable and profitable. If you need a refresher on the fundamentals, we have a complete guide that explains how to calculate customer lifetime value in detail.

A Real-World Scenario: Two Channels Go Head-to-Head

Let’s say you’re running two campaigns to get customers for your subscription box service.

- Campaign A (TikTok Ads): You spend £5,000 and get 250 new customers. Your CAC is a lean £20 per customer.

- Campaign B (Google Search Ads): You spend £5,000 and get 125 new customers. Your CAC is £40 per customer.

Based on immediate ROI and CAC alone, Campaign A looks like the obvious winner. You’re getting customers for half the price. But hold on, let’s bring LTV into the picture.

After digging into your data over the next 12 months, you find a crucial difference:

- Customers from Campaign A are more transactional. They tend to buy once and then churn. Their average LTV is just £60.

- Customers from Campaign B are far more loyal. They were actively searching for a solution, found your brand, and they stick around. Their average LTV is £240.

Now, let’s see what happens when we look at the LTV to CAC ratio.

| Metric | Campaign A (TikTok Ads) | Campaign B (Google Search Ads) |

|---|---|---|

| Customer Acquisition Cost (CAC) | £20 | £40 |

| Customer Lifetime Value (LTV) | £60 | £240 |

| LTV to CAC Ratio | 3:1 | 6:1 |

The channel that looked twice as expensive on the surface is actually delivering twice the long-term value. This insight completely flips your investment strategy. You now realise that putting more budget into Google Search, despite the higher initial cost, is the key to building a more profitable customer base.

This example is precisely why an LTV-centric view is so critical. It pulls you away from chasing cheap clicks and pushes you toward acquiring the right customers—the ones who will fuel your business for years. It’s a more patient, strategic, and ultimately more rewarding way to measure the true impact of your marketing.

Automating Your Reporting for Continuous Optimisation

Manual ROI calculations are a dead end. Seriously. They’re not just slow and tedious; they’re dangerously prone to human error. If you want to truly master how you measure marketing ROI, the final piece of the puzzle is building an automated system that frees you up to focus on strategy, not spreadsheets.

This means creating an always-on reporting dashboard that puts your most important ROI metrics right in front of you, on a schedule that works for you. No more exporting CSVs or wrestling with pivot tables. Instead, you get a consistent, reliable snapshot of performance that helps you spot trends and make faster, smarter decisions.

This shift from manual analysis to automated insight is what separates reactive marketing teams from proactive ones. It’s about building a system that works for you, giving you the headspace to think bigger.

Setting Up Your Automated Dashboard

First things first: decide what information you actually need at a glance. An effective ROI dashboard shouldn’t be a cluttered mess of every metric imaginable. It should be a curated view of the vital signs of your marketing engine, focusing squarely on profitability and efficiency.

Your core dashboard should prominently feature:

- Overall Profit ROI: The big-picture number. How is your entire marketing budget performing?

- Channel-Specific Profit ROI: A breakdown showing the profitability of individual channels like Google Ads, Meta Ads, and email.

- LTV to CAC Ratio: Your north star metric for sustainable growth, tracked over time.

- Top Performing Campaigns: A list of the campaigns driving the most profit, not just revenue.

Modern business intelligence (BI) tools or specialised analytics platforms like Menza can connect directly to your data sources—your ad accounts, e-commerce store, and finance software—to pull this information automatically. This ensures your dashboard is always populated with real-time, accurate data.

The goal of an automated dashboard isn’t to replace deep analysis; it’s to make it more efficient. It should answer 80% of your recurring questions instantly, freeing up your time to investigate the more complex “why” behind the numbers.

Once it’s built, schedule this report to be emailed to key stakeholders every Monday morning. This simple routine creates a powerful cadence of accountability and keeps everyone aligned on the metrics that truly matter.

Creating Intelligent Performance Alerts

Dashboards are brilliant for tracking trends, but you unlock their real power when you pair them with intelligent, automated alerts. These are proactive notifications that tell you when something needs your immediate attention, letting you act before small issues become costly problems.

Instead of waiting for your weekly report to discover a problem, alerts can notify you in real-time. This is where AI-powered monitoring tools excel. They can continuously watch your connected data and send you a plain-English message when performance deviates from your targets.

Consider setting up alerts for critical events like:

- Sudden ROI Drops: Get an alert if a specific campaign’s Profit ROI falls below a set threshold (e.g., below 1.5x) for more than 48 hours.

- Ad Spend Spikes: Be notified if ad spend on a channel outpaces revenue growth by a certain percentage.

- CAC Increases: Receive a notification if your blended Customer Acquisition Cost rises more than 20% week-over-week.

This automated vigilance acts as an early warning system. Imagine getting an email that says, “Your ‘Spring Sale’ Meta campaign ROI has dropped by 40% in the last 24 hours due to a spike in cost-per-click.” That’s an actionable insight that lets you investigate and fix the problem immediately, saving potentially thousands in wasted ad spend.

Key ROI Metrics to Monitor Automatically

To get started, here’s a quick look at the essential metrics to track, how to calculate them, and how often you should be checking in. Setting up automated monitoring for these is a great first step.

| Metric | How to Calculate It | Monitoring Frequency |

|---|---|---|

| Profit ROI | (Gross Profit - Marketing Investment) / Marketing Investment | Weekly |

| LTV:CAC Ratio | Customer Lifetime Value / Customer Acquisition Cost | Monthly/Quarterly |

| Payback Period | CAC / (Average Monthly Revenue per Customer × Gross Margin %) | Monthly/Quarterly |

| Cost Per Acquisition (CPA) | Total Spend / Number of Acquisitions | Daily/Weekly |

| Channel-Specific ROI | (Channel Profit - Channel Spend) / Channel Spend | Weekly |

Putting these metrics on autopilot doesn’t mean you stop paying attention. It means you stop wasting time on the grunt work of data collection and start spending more time on the strategic work that actually grows the business. This is the future of data-driven marketing—letting machines monitor the numbers so you can focus on making the right moves.

Common Questions About Measuring Marketing ROI

Once you start getting serious about measuring marketing ROI, the same questions always come up. They’re the tricky, nuanced problems that dashboards don’t answer cleanly. I’ve heard them from countless founders and marketers, so let’s tackle them head-on.

Think of this as your field guide to the messy reality of ROI measurement.

How Do I Measure the ROI of Content or Brand Marketing?

This is the classic dilemma. How do you pin a number on a blog post or a brand campaign that doesn’t lead directly to a sale? The short answer is: you don’t, at least not in the same way you measure a Google Ad.

Top-of-funnel activities are a long game. You have to shift your focus from immediate transactions to leading indicators and longer time horizons.

For something like content marketing, you need to track proxy metrics that show you’re building an asset over time. Are you seeing:

- Organic Traffic Growth: A steady, month-over-month climb in visitors from search engines?

- Keyword Rankings: Your content showing up for valuable terms that your ideal customers are searching for?

- Assisted Conversions: How often did a blog post show up in a customer’s journey before they eventually bought? You can find this in Google Analytics, and it’s often an eye-opener.

For brand campaigns, look for lifts in things like branded search volume (are more people typing your company name into Google?) and increases in direct traffic. The goal is to see a sustained rise in these metrics that correlates with a higher baseline of sales over a quarter, or even a year.

Don’t expect a sale from every blog post. The true value lies in building an audience and influencing future purchases. The ROI is realised over months, not days.

What Is a Good Marketing ROI for an Ecommerce Business?

Everyone wants a single number, but the “right” answer depends entirely on your margins, your growth stage, and your cash flow. A popular benchmark you’ll hear thrown around is a 5:1 revenue ROI (ROAS). Honestly, that’s a vanity metric.

As we’ve covered, profit-based ROI is the only number that really tells you if your marketing is building a sustainable business.

Data from WARC suggests a median profit ROI of 2.43:1 is a strong target. This means for every £1 you put into marketing, you get £2.43 back in actual profit. That’s a healthy, sustainable engine. Your number might be different. A venture-backed startup might happily accept a lower (or even negative) ROI to grab market share, while a bootstrapped brand will need much higher profitability to survive.

How Often Should I Review My Marketing ROI?

The review cadence should match the channel’s feedback loop. For fast-moving channels like Meta or Google Ads, where you can tweak bids and creative daily, you need to be checking in weekly, if not daily. Waiting a month to discover an ad is burning cash is a recipe for disaster.

But for channels with a longer tail, like SEO or content marketing, a monthly review is much more practical. It gives the data enough time to show meaningful trends, so you don’t overreact to a few slow days. A good system we’ve seen work well is an automated weekly summary of key channel ROIs, followed by deeper strategic reviews monthly and quarterly to guide your budget.

Why Is My Ad Platform ROAS High but My Business Is Not Profitable?

This is probably the single most important and most common problem we see. It’s the perfect illustration of why a profit-first approach is non-negotiable. The disconnect happens because your ad platform’s ROAS lives in a fantasy world where your only cost is the ad spend itself.

Your ad manager has zero clue about your actual business costs:

- Cost of Goods Sold (COGS)

- Shipping and fulfilment costs

- Payment processing fees

- Return rates and refund costs

A 4:1 ROAS might look amazing inside Meta’s dashboard. But if your total profit margin after all those real-world costs is only 20%, you are actively losing money on every single sale from that campaign. You’re paying £1 to make £4 in revenue, but that £4 of revenue only generates £0.80 of profit. You’re losing 20p on every conversion.

You have to calculate a true, profit-based ROI by pulling data from your e-commerce platform and finance tools. Never, ever trust the ad platform’s number as the final word on your profitability.

Ready to stop guessing and get clear, trusted answers about your marketing performance? Menza is an AI-powered data analyst that connects to your entire stack—from Shopify and Google Ads to your spreadsheets—and delivers decision-ready insights in plain English. Get started with Menza today and turn your data into your most valuable asset.

Stop guessing. Start knowing.

Menza connects to your Shopify, Klaviyo, ad platforms, and 650+ other data sources. Ask questions in plain English and get answers you can trust — no spreadsheets, no code, no waiting.